401k Contribution Limits 2025 Over 50 Catch Up. Plan participants in these plans may wish to consider the impact of the dollar. Since most people are in a lower tax bracket in retirement than they are when they are working, this can save you a lot of money.

The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025. The limit for overall contributions—including the employer match—is 100% of.

The ira catch‑up contribution limit for individuals ages 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000, the irs said.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Irs releases the qualified retirement plan limitations for 2025: 401k catch up contribution limit 2025.

401(k) Contribution Limits in 2025 Meld Financial, 2025 401k limits contribution over 50. Solo 401(k) contribution limits for 2025.

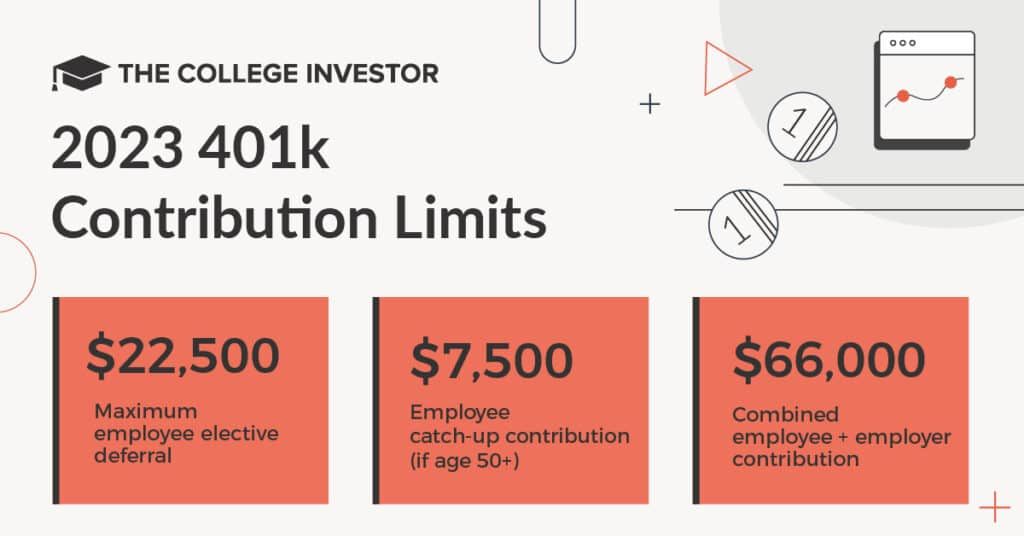

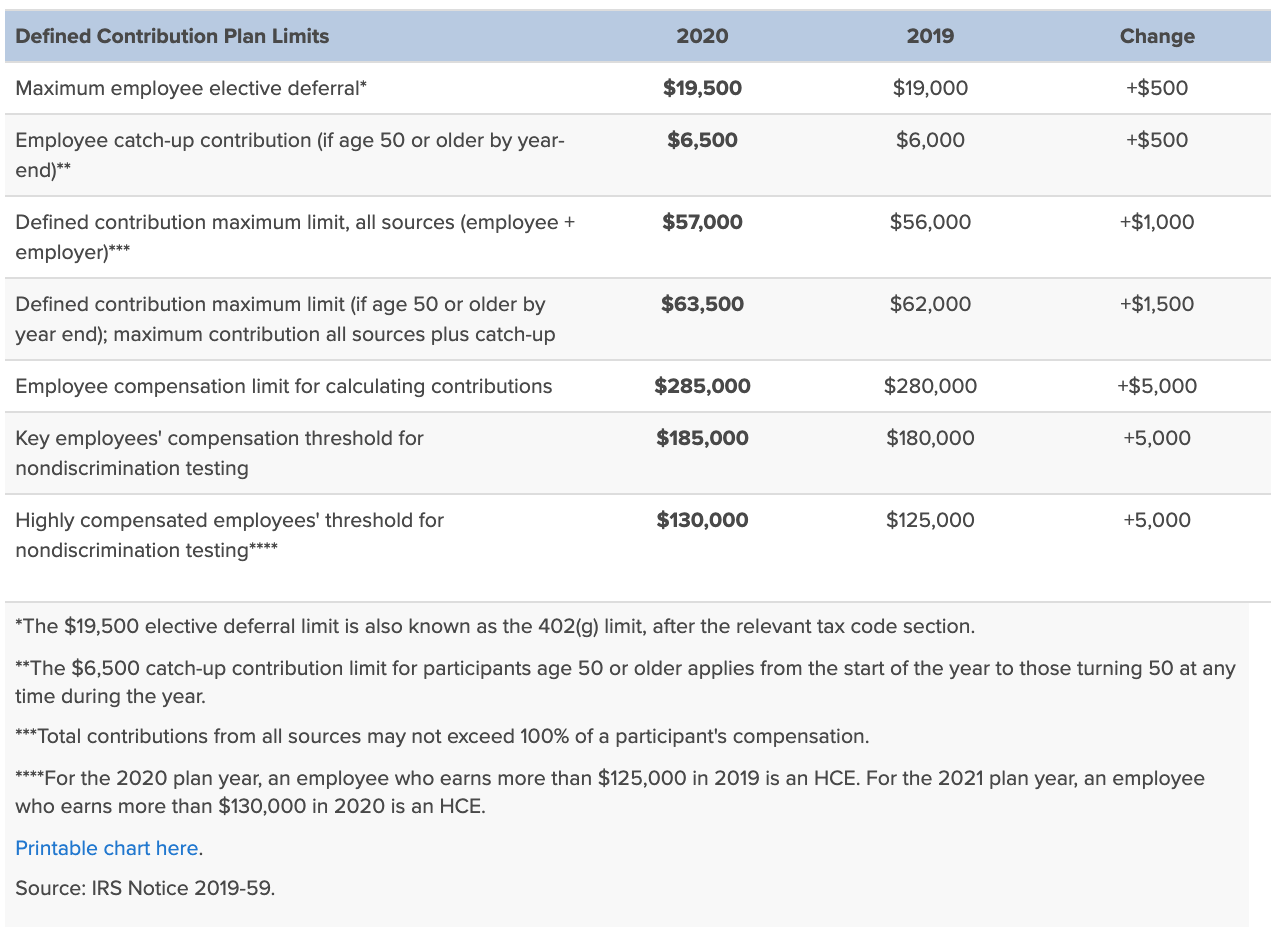

401k 2025 Contribution Limit Chart, Irs releases the qualified retirement plan limitations for 2025: The 401(k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

The IRS just announced the 2025 401(k) and IRA contribution limits, Total contributions cannot exceed 100% of an employee’s annual. The 401(k) contribution limit for 2025 is $23,000.

401k contribution limits 2025 Choosing Your Gold IRA, 401k contribution limits 2025 over 50. This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase.

Lifting the Limits 401k Contribution Limits 2025, 401(k) contribution limits for 2025. Total contributions cannot exceed 100% of an employee’s annual.

401k Maximum Contribution Limit Finally Increases For 2019, For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000. This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase.

401k Contribution Limits For 2025, The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and. The ira catch‑up contribution limit for individuals ages 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000, the irs said.

Solo 401k Contribution Limits For 2025 & 2025 41C, The 401(k) contribution limit for 2025 is $23,000. Irs releases the qualified retirement plan limitations for 2025:

Maximum Limit For Roth Ira, The ira catch‑up contribution limit for individuals ages 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000, the irs said. The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025.

Travel Hiking WordPress Theme By WP Elemento